I started to write about my move to a new personal finance software package and ended up on a completely different topic. I think this is an important subject, as I have two teenage boys and neither one of them has any money management experience. Fortunately, my oldest son started his first job last year, at the age of 16; it has been a very valuable life experience. His first paychecks seemed to last less than a day, burning right through his pockets! To curb his spending sprees, I made him start a savings account; this was to save for college or something unplanned. After about a year, I can see that his paycheck has a little more value; it actually seems to last a little longer! Now that he is spending more of his own money, he is starting to see the need for a little planning: gas for the car, Subway, Slurpees, and going to the movies.

I started to write about my move to a new personal finance software package and ended up on a completely different topic. I think this is an important subject, as I have two teenage boys and neither one of them has any money management experience. Fortunately, my oldest son started his first job last year, at the age of 16; it has been a very valuable life experience. His first paychecks seemed to last less than a day, burning right through his pockets! To curb his spending sprees, I made him start a savings account; this was to save for college or something unplanned. After about a year, I can see that his paycheck has a little more value; it actually seems to last a little longer! Now that he is spending more of his own money, he is starting to see the need for a little planning: gas for the car, Subway, Slurpees, and going to the movies.

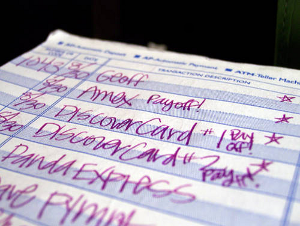

- Checkbook balancing is a method of verification

- Both banks and merchants can make mistakes

- Overdrawn account, bounced check fees, monthly service fees

- On-line Banking is not always real-time

- Help you budget your money

I like to keep an eye on the transactions, I can easily make sure that I’m not double billed or paying for some unexpected transaction fee. A topic for another post, is the value of budgeting. I bet even fewer people actually create monthly budgets. I have always maintained a personal budget, though not always been able to live within it! Because I tracked my spending, I always knew where the money went and how big the problem was. I am back to using personal finance software; I manage and live within my budget and reconcile my accounts every month. It takes no time at all and I always know exactly where I stand. Unfortunately, I have not been able to get my son to balance his checkbook yet, but I do have all of his statements printed out and ready to go; we just never seem get to it. I now realize, this is even more important than I originally thought.. this is a fundamental life skill that I have to share with him, before he sets off on his own.

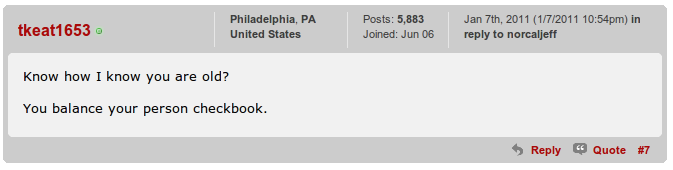

Over the past few years, a friend of mine has ranted about this problem several times; he actually wanted to teach high school kinds some basic money management skills. Amazingly, neither the public school system nor parents are teaching this fundamental skill, it should be no different from the other fundamentals: Reading, Writing, and Arithmetic. Now, you really know how old I am! Here is good post that illustrates the point well, Why Can’t Johnny Balance A Checkbook?