For about that last five years, I was keeping an old Windows XP laptop around just to do my checkbook. I have already documented my need to balance my checking account and maintain a budget. I don’t think think most people use a budget to manage their spending, I think most people just spend what they have and hope for the best! Over the past year, I have worked for four different companies and each one had a different pay schedule. One company paid weekly, which was very nice and seemingly minimized the need for a budget; another company paid monthly, which made having a budget very important.

For about that last five years, I was keeping an old Windows XP laptop around just to do my checkbook. I have already documented my need to balance my checking account and maintain a budget. I don’t think think most people use a budget to manage their spending, I think most people just spend what they have and hope for the best! Over the past year, I have worked for four different companies and each one had a different pay schedule. One company paid weekly, which was very nice and seemingly minimized the need for a budget; another company paid monthly, which made having a budget very important.

I have been a loyal Quicken user since the early 90s; so loyal that I upgraded just about every year! Somewhere along the way, I abandoned Quicken and moved to Microsoft Money. Money was much more polished and worked very well. Unfortunately, Microsoft observed the same trend, recognizing that people were no longer interested in personal finance software and decided to stop supporting their Money product. I continued to use Money until Microsoft disabled my online access, forcing me to move back to Quicken.

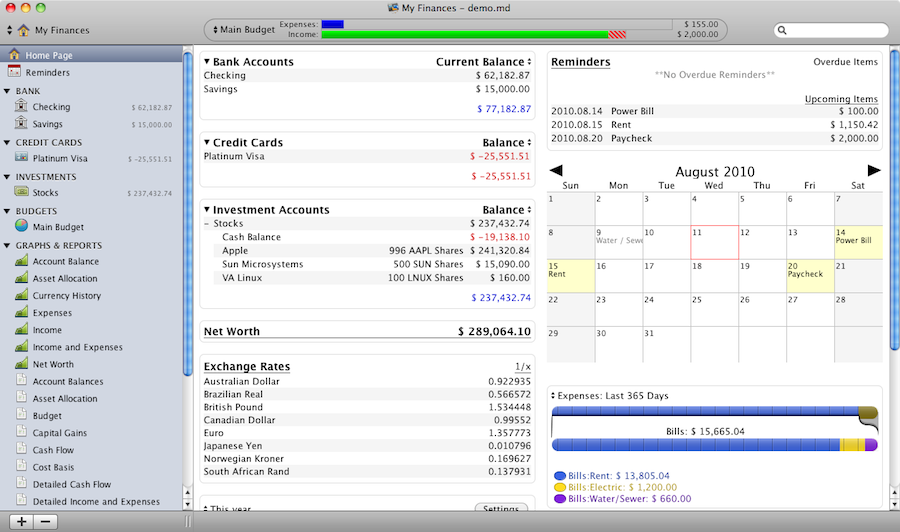

I moved into a new place last summer and for some reason my little XP laptop did not survive the move. Since that was my only Windows machine, I had a little bit of problem.. no way to run Quicken. I researched running some Windows emulators on my Ubuntu machine, but did not go down that path. Instead, I decided to look into Linux options; more than that, I wanted something that would be cross-platform, supporting multiple operating systems and hopefully have some mobile or tablet support. I did quite a bit of research and decided to give Moneydance a try. Moneydance met most of my criteria and had a really nice trial option; it allows you to import or download an unlimited number of transactions. There is only one limitation using the trial version, you can only manually enter 100 transactions. Because I was able to configure Moneydance to download transactions form most of my financial institutions, I was able to use the trial version for several months before hitting the limit.

Fortunately, I have good backup process and still had access to my Quicken files. After jumping through some hoops, I was able to export all of my relevant accounts to QIF files which I could then import into Moneydance. I had quite a bit of data, having over twenty years of investment transaction history. Importing the data was a pretty trivial process as I remember.

Is Moneydance perfect? Probably not. If you are a looking at this from a Linux perspective, you will be pretty happy. The software is by no means “pretty”, but it has all of the features that I need. I’m sure that some people might not get past the basic, no frills user experience, but it is a very solid application and I have zero stability issues. I never thought that Quicken was very cool looking, which is why I switched to Money. After switching, I think Quicken stepped up their User Interface game and made Quicken much more attractive and user friendly. I would say that Moneydance is far from user friendly but is still usable; I’m probably able to put aside all of my normal aesthetic requirements, as it much more important that I can run the software on my Ubuntu box.

I think Moneydance works for me because it really works well for people that work from a budget perspective. The main screen has several components that help you manage your spending, including a calendar to show your upcoming transactions and reminders, a snapshot of your budget’s current income to expense totals, as well as the ability to track and highlight specific budget categories. The main screen provides you everything you need to monitor your monthly spending.

I does all of the mundane transaction management activities

- Download online transactions

- Manage investment accounts

- Setup and maintain a budget

- Large variety of reports.

This has been setting in my drafts for 7 years, I guess it is time to publish it. And for what it is worth, I’m still using Moneydance!